Alphabet’s Gv Uses an Algorithm to Approve Investments, Overriding Human Vcs

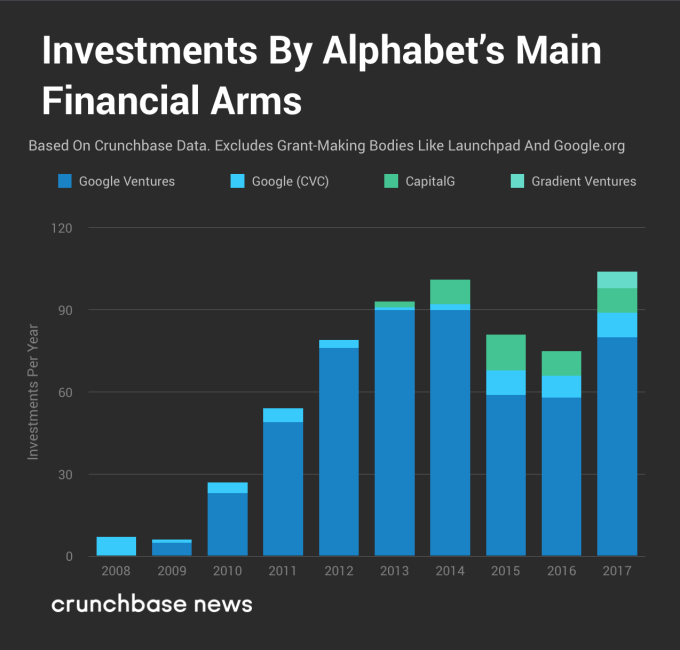

Letters in order Inc's. funding arm GV, previously Google Adventures, has supplanted people with computerized reasoning with regards to speculation choices, basically as per a report distributed Thursday.

Axios made the case, saying that GV utilizes a calculation called "The Machine" that successfully allows or precludes both new and follow-on ventures.

The Machine, which seems to utilize a blend of AI and computerized reasoning to go with speculation choices, settles on its choices in light of information feed into it by staff individuals.

The information comprises of data about the specific organization, market information, round size, organization accomplices, past financial backers, industry area and the delta between earlier valuation and current valuation.

The calculation is then said to utilize a traffic signal style arrangement of pointers on a given speculation. A green light demonstrates that a speculation opportunity is a go, a red light method don't contribute and a yellow light shows tread carefully — however Axios' sources noticed that a yellow is typically what could be compared to red.

Assuming that supplanting people with man-made intelligence for multimillion-dollar speculation choice isn't sufficient, The Machine is additionally said to have been utilized to source bargain amazing open doors however evidently wasn't excessively fruitful in doing as such.

The report guaranteed that information on the machine is notable among GV's accomplices, who "have been known to take a stab at gaming the machine, controlling contributions to come by the ideal outcomes."

Those equivalent financial backers obviously aren't especially enamored with its dynamic ability either, noticing that The Machine "has torn out their guts, conceivably costing them worthwhile open doors (especially a portion of the more unsafe wagers that frequently transform into adventure's greatest successes)."

A transition to robots, or for this situation a simulated intelligence based processing stage, instead of human dynamic is certainly not an immense shock given expectations that robot computerization will supplant upwards of 800 million positions by 2030.

The Axios report notes, genuinely, that investment is as much a craftsmanship as a science and subsequently it's sketchy whether a robot can constantly pursue the best choice.

As per Axios, The Machine is taken care of various contributions on a venture an open door (for example industry, raise support size, financial backers, and so forth), then, at that point, the calculation scores it on a 10-point scale and gives each a green (scores over a 8), yellow or red position.

The Machine suggests just procedure with green positioned speculation open doors. Given adventure speculations are in youthful organizations absent a lot of history to dissect, financial backers will generally depend on human judgment ("stomach"). Choices surrendered to destroy are inclined to human inclinations and mistake that can crash a firm like GV from making effective speculations.

To attempt to acquire an upper hand against other funding firms, GV is endeavoring to make an information driven speculation process that beats essentially utilizing stomach. Dissimilar to the issue with organization explicit information of youthful firms, industry, organizer, round and financial backer information is practically boundless!

Through The Machine, GV is utilizing AI to assist with examining the limitless measure of information encompassing a speculation chance to find the elements that make specific ventures effective. Whenever developed accurately, The Machine would make an enormous benefit for GV in its speculation endorsement process.

In 2013, GV's previous Chief, Bill Maris, expressed "We approach the world's biggest informational indexes you can envision… It would be stupid to simply go out and make stomach ventures". To expand The Machine's true capacity, GV is probably centered around tackling the data access they remarkably have as an auxiliary of Letter set today (it is critical to note GV declined to remark on Axios' story).

There are other funding firms attempting to likewise utilize AI to further develop their speculation interaction (most outstandingly Sharpen Capital and EQT Adventures. however they all come up short on extraordinary informational collections conscious of Letter set.

With tremendous measures of information, GV needs to now zero in on translating between signals for good speculations and clamor to construct The Machine to be an adaptable model that can take a gander at a bunch of various venture open doors.

As GV keeps on fining tune its AI cycle, it absolutely appears to be that the more drawn out term objective is to have The Machine be the "true venture advisory group" eliminating the stomach part of effective money management. Indeed, even with prevalent outcomes, a machine-based process being the last judge of ventures will find opportunity to get full purchase in.